Stablecoin Market Dynamics Shift: USDC Dominance Doubles, Rising Star USDe Emerges

Original Article Title: "The State of Stablecoins 2025: Supply, Adoption & Market Trends"

Original Article Author: Artemis, Dune

Original Article Translation: Yuliya, PANews

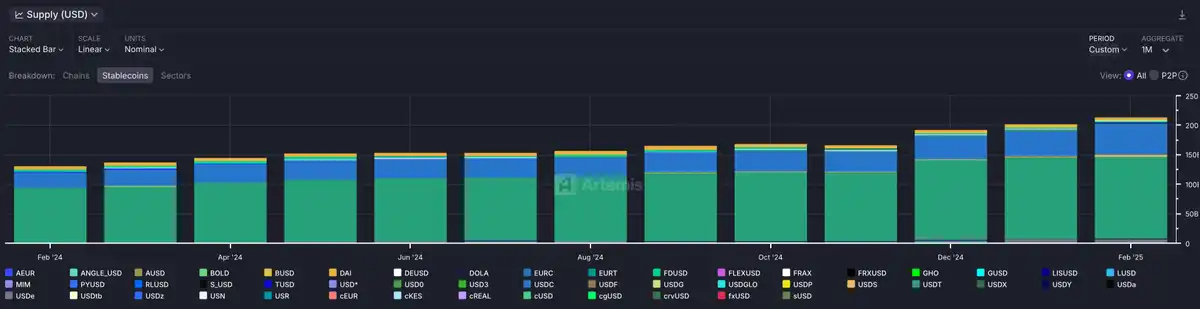

Stablecoins are reshaping the global financial system at an unprecedented pace. According to the joint report "Stablecoin State in 2025" released by Dune and Artemis, the stablecoin market has experienced significant growth in the past year, institutional adoption has accelerated, decentralized stablecoins have emerged, and on-chain transaction activity continues to rise.

Market Size and Growth Trends

As of February 2025, the supply of stablecoins has reached $2.14 trillion, with an annual transaction volume of $35 trillion, doubling the size of Visa's annual transaction volume. Market activity is on the rise, with a 53% increase in on-chain active addresses, surpassing 30 million. Institutional funds are flowing in on a large scale, driving deep integration between Traditional Finance (TradFi) and the crypto market.

Shift in USDC and USDT Dominance

Driven by the compliance process and market strategies, USDC and USDT still dominate the market, but there have been subtle shifts in market share.

USDC's market capitalization has doubled to $560 billion, mainly due to regulatory approvals under MiCA and DIFC, the participation of key strategic partners such as Stripe and MoneyGram, and rapid global market expansion.

USDT's total market capitalization has grown to $1.46 trillion, remaining the largest stablecoin by market capitalization, but its market share has declined. Institutional adoption is decreasing, and the focus is gradually shifting to the P2P remittance market, consolidating its position in the global payment sector.

Rise of Decentralized Stablecoins

In the Decentralized Finance (DeFi) ecosystem, the influence of decentralized stablecoins has significantly increased, with several emerging projects achieving breakthrough growth.

· USDe (Ethena Labs): Its market value surged from $1.46 billion to $62 billion, becoming the third-largest stablecoin in the market. The key to its growth lies in its innovative yield strategy and Delta-neutral hedging mechanism.

· USDS (MakerDAO): MakerDAO has rebranded as Sky and launched the compliance-friendly USDS, with a market capitalization reaching $2.6 billion in February 2025. This adjustment has enhanced its competitiveness in the decentralized stablecoin market.

Fund Flows and Industry Distribution

The flow of stablecoins reflects the positioning and competitiveness of different blockchains in the market:

Ethereum remains the primary issuance platform for stablecoins, holding a 55% supply share. Base and Solana have seen rapid growth in transaction volume, driven by the DeFi and Meme coin markets, becoming key on-chain ecosystems for stablecoin circulation. TRON continues to hold a core position in the global P2P payment and cross-border remittance markets, especially in emerging markets, where stablecoins are widely used for payments and savings.

Most stablecoin liquidity is concentrated on centralized exchanges (CEX), with transaction volumes mainly driven by DeFi (DEX, lending, yield farming), reflecting efficient capital flow and innovation.

Core Functions and Future Development

Stablecoins have become a critical infrastructure in the crypto market and are also driving innovation in the traditional financial sector. Industry experts are optimistic about the future development of stablecoins:

"Stablecoins are the lifeline of the crypto market and the superconductor of the financial system. They have opened up new markets and financial opportunities, driving innovation that was previously out of reach." — Rob Hadick, General Partner at Dragonfly

"Stablecoins have significant advantages in cross-border payments. We hope Base will support more local currency stablecoins, allowing global users to transact on-chain with their familiar currencies, thus increasing the adoption of blockchain technology." — Neodaoist, Product Lead at Base

"The next generation of stablecoins must have market resilience. The core of USDe is a yield-backed stability mechanism, ensuring users have a reliable USD alternative." — Conor Ryder, Head of Research at Ethena Labs

"The flow of stablecoins depends on the quality of infrastructure — low cost, fast transactions, and market demand. On Solana, the liquidity for Meme coin trading pairs and instant settlement is high, making stablecoins an indispensable part." — Andrew Hong, Founder and Data Analytics Expert at Herd

「TRON has become the preferred blockchain for stablecoin transactions, with daily trading volumes reaching billions of dollars. USDT on TRON has driven real economic activities, especially in emerging markets, and has become a key tool for payments and savings.」 ——TRON DAO Community Spokesperson Sam Elfarra

You may also like

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

Billionaire Michael Saylor’s Strategy Buys $75M of More Bitcoin – Bullish Signal?

Key Takeaways Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by acquiring an additional 855 BTC…

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…