The Trilemma of the New Crypto Economy: The Intersection of Energy, Cutting-Edge Technology, and Stablecoins

Original Article Title: Energy, Frontier, Stablecoin

Original Article Authors: @ManoppoMarco, @primitivecrypto Investors

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: This article explores the current status and future direction of the cryptocurrency industry, suggesting that innovation in the crypto space has become flat, with new technologies and projects failing to bring breakthroughs. The author believes that true innovation should combine the core features of crypto, such as incentive mechanisms, asset liquidity, and seamless transfer, to address macro issues. By integrating energy, frontier technology, and stablecoin, the crypto industry can be propelled to a higher level of development.

The following is the original content (slightly reorganized for clarity):

This is the first part of an exploratory paper series that I will be writing in the coming weeks.

Is the crypto industry getting boring... or growing? Over the past few months, Crypto Twitter's mood has been mixed, with both excitement and fatigue, mainly due to two reasons:

· The trench is dead.

· The institutions are here to take your lunch money.

The former means that the rebellious, cypherpunk-style innovation is no longer as prevalent in the crypto industry as it was in the past. Since DeFi unlocked our imagination in 2019, there has been no real 0 to 1 innovation in our field. Of course, blockchain has become faster, and we are all working hard to help traditional finance save 30 basis points through asset tokenization (which is a trillion-dollar opportunity!), but it can also be said that the original spirit of crypto is slowly fading away.

The latter means that the current crypto space is filled with MBA graduates and professional protocol hoppers (I swear I will make PPH a real term), who now dominate our field. These professionals, hey, I bet some senior managers of big protocols haven't even tried issuing their own coin on PumpFun.

Overall, observing all this has made me start thinking about which possible new verticals we can explore to get my CT friends excited again.

Frankly, I don't think what's happening in the crypto industry is bad or boring; it's just the natural progression of business and tech cycles within a maturing vertical.

But hey, maybe I'm too pragmatic. So, what's new?

New virtual machines, new blockchains, and new Ponzi economics will continue to attract funding, especially in the early stages. Because crypto is still the world's best capital market. Ask any Web2 VC friend of yours how things are on their end, and you might think we're no longer in a bear market.

But these optimizations have become somewhat boring; even though they still bring returns to early investors, they haven't unlocked new mechanisms or driven new business models that propel our industry forward.

Therefore, this article is an attempt to imagine things that could drive the industry forward.

My assumption is that the answer lies in the combination of the following three intersections:

· Energy

· Cutting-edge Technology

· Stablecoins

Let's dissect these three concepts.

Triumvirate

The original meaning of "Triumvirate" was the rule of three men—referring to the informal alliance of Caesar, Pompey, and Crassus in 60 BC. If you think I'm a bit old-fashioned, go with your gut.

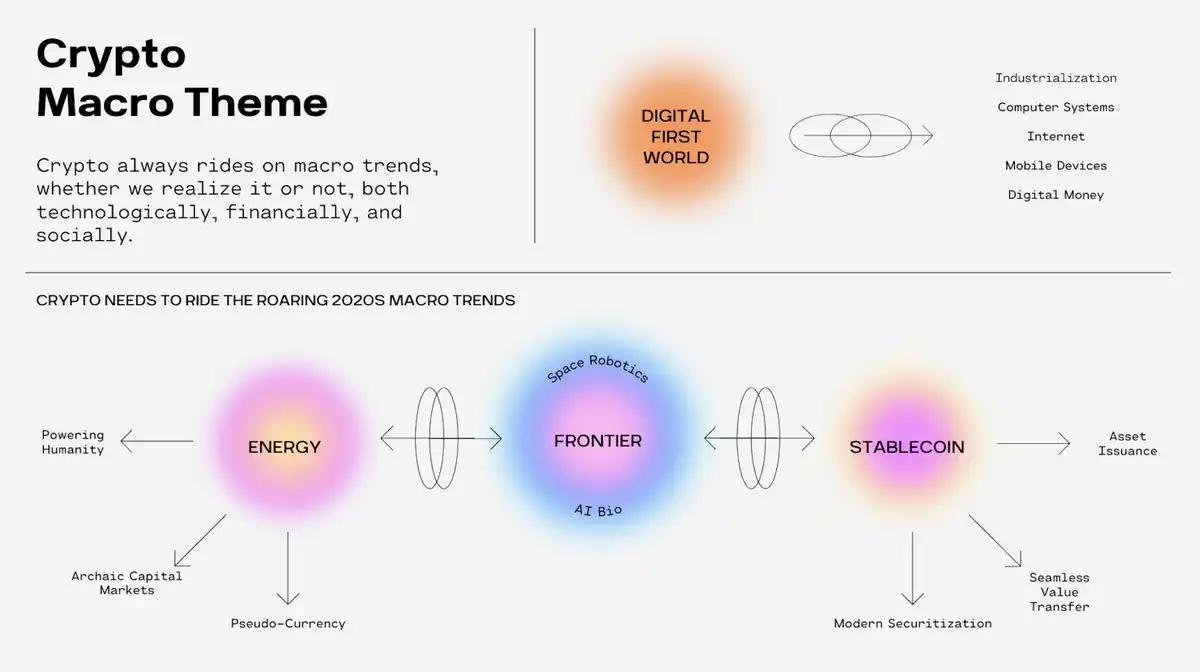

I believe that crypto is fundamentally a macro asset. The technological and capital market value that crypto provides is most effective when combined with macro trends. Digitalization was the earliest trend that brought crypto into our world. In an increasingly digital world, there has to be a native way to exchange value -> hence crypto.

Now, the world is undergoing several macro trends:

· Energy: Demand for more energy

· Cutting-edge Technology: Demand for technological advancement

· Stablecoins: Demand for seamless value transfer

These three constitute the crypto Triumvirate. By properly combining these three verticals, crypto can be propelled to the next level.

I'll be the first to admit that, taken individually, this concept is not groundbreaking. Some funds have already started focusing on the convergence of crypto and energy, such as @uraniumdigital_ and @daylightenergy_'s recent funding rounds; while some have explored the combination of crypto and cutting-edge technology, like @openmind_agi and @Spacecoin_xyz.

The key is, when you combine these three elements, what kind of product and incentive mechanism flywheel can you ignite.

· A DeFi project without asset issuance? Boring.

· A stablecoin without real-world use case? Oversaturated.

· Cutting-edge technology without a crypto flywheel? Pointless.

In Summary

How to leverage the best attributes of crypto: incentive mechanisms, populism, and seamless asset creation/transfer, and combine them with the most interesting problems of our generation — not just for the sake of a forced narrative, but because the nature of crypto can truly create a better product and incentive flywheel for the problem you are solving.

I once read a saying, stripped of everything, there are only two ways to make money:

· You create value and convert it into money

· You facilitate the flow of funds and charge a fee

I believe that crypto, if done right, will embody both methods (1) and (2) simultaneously.

In the second part, I will explore the first-generation existing mechanisms/business models of these tripartite political projects and consider what might happen when they are combined.

You may also like

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…

Average Bitcoin ETF Investor Turns Underwater After Major Outflows

Key Takeaways: U.S. spot Bitcoin ETFs hold approximately $113 billion in assets, equivalent to around 1.28 million BTC.…

Japan’s Biggest Wealth Manager Adjusts Crypto Strategy After Q3 Setbacks

Key Takeaways Nomura Holdings, Japan’s leading wealth management firm, scales back its crypto involvement following significant third-quarter losses.…

CFTC Regulatory Shift Could Unlock New Opportunities for Coinbase Prediction Markets

Key Takeaways: The U.S. Commodity Futures Trading Commission (CFTC) is focusing on clearer regulations for crypto-linked prediction markets,…

Hong Kong Set to Approve First Stablecoin Licenses in March — Who’s In?

Key Takeaways Hong Kong’s financial regulator, the Hong Kong Monetary Authority (HKMA), is on the verge of approving…

BitRiver Founder and CEO Igor Runets Detained Over Tax Evasion Charges

Key Takeaways: Russian authorities have detained Igor Runets, CEO of BitRiver, on allegations of tax evasion. Runets is…

Crypto Investment Products Struggle with $1.7B Outflows Amid Market Turmoil

Key Takeaways: The recent $1.7 billion outflow in the crypto investment sector represents a second consecutive week of…

Why Is Crypto Down Today? – February 2, 2026

Key Takeaways: The crypto market has seen a downturn today, with a significant decrease of 2.9% in the…

Nevada Court Temporarily Bars Polymarket From Offering Contracts in the State

Key Takeaways A Nevada state court has temporarily restrained Polymarket from offering event contracts in the state, citing…

Bitcoin Falls Below $80K As Warsh Named Fed Chair, Triggers $2.5B Liquidation

Key Takeaways Bitcoin’s price tumbled below the crucial $80,000 mark following the announcement of Kevin Warsh as the…

Strategy’s Bitcoin Holdings Face $900M in Losses as BTC Slips Below $76K

Key Takeaways Strategy Inc., led by Michael Saylor, faces over $900 million in unrealized losses as Bitcoin price…

Trump-Linked Crypto Company Secures $500M UAE Investment, Sparking Conflict Concerns

Key Takeaways A Trump-affiliated crypto company, World Liberty Financial, has garnered $500 million from UAE investors, igniting conflict…

Billionaire Michael Saylor’s Strategy Buys $75M of More Bitcoin – Bullish Signal?

Key Takeaways Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by acquiring an additional 855 BTC…

Russia’s Largest Bitcoin Miner BitRiver Faces Bankruptcy Crisis – What Went Wrong?

Key Takeaways BitRiver, the largest Bitcoin mining operator in Russia, faces a bankruptcy crisis due to unresolved debts…

Polymarket Predicts Over 70% Chance Bitcoin Will Drop Below $65K

Key Takeaways Polymarket bettors forecast a 71% chance for Bitcoin to fall below $65,000 by 2026. Strong bearish…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies holds 4,285,125 ETH, which is approximately 3.55% of Ethereum’s total supply. The company…

US Liquidity Crisis Sparked $250B Crash, Not a ‘Broken’ Crypto Market: Analyst

Key Takeaways: A massive $250 billion crash shook the cryptocurrency markets, attributed largely to liquidity issues in the…

Vitalik Advocates for Anonymous Voting in Ethereum’s Governance — A Solution to Attacks?

Key Takeaways Vitalik Buterin proposes a two-layer governance framework utilizing anonymous voting to address collusion and capture attacks,…

South Korea Utilizes AI to Pursue Unfair Crypto Trading: Offenders Face Severe Penalties

Key Takeaways South Korea is intensifying its use of AI to crack down on unfair cryptocurrency trading practices.…