「Zero Fee」 Illusion: Lighter Nodes Shifted Costs with High Latency

Original Article Title: Lighter's "0% Fees" Are Actually 5-10x More Expensive Than Other Exchanges

Original Article Author: @PerpetualCow, Crypto Influencer

Original Article Translation: AididiaoJP, Foresight News

There's a saying in the market: If a product is free, then you are the product.

Lighter DEX is currently promoting "zero fees" to retail traders. It sounds too good to be true, and indeed it is.

However, what Lighter didn't prominently display is the toll structure behind these "free" trades.

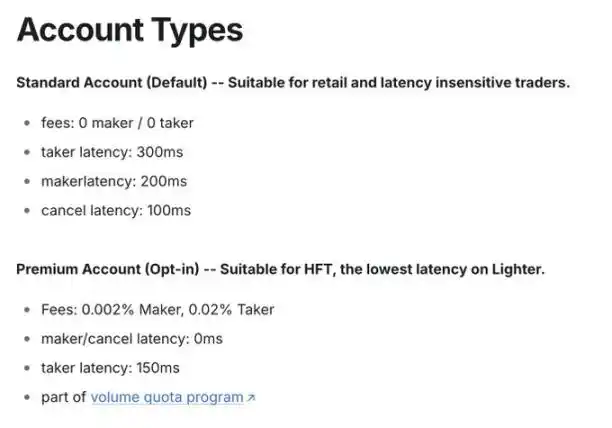

Lighter offers two account types: once you understand how the toll structure works, you'll realize that the 0% fee is actually the most expensive tier on the platform.

That 200-300 millisecond delay is the crux of their business model.

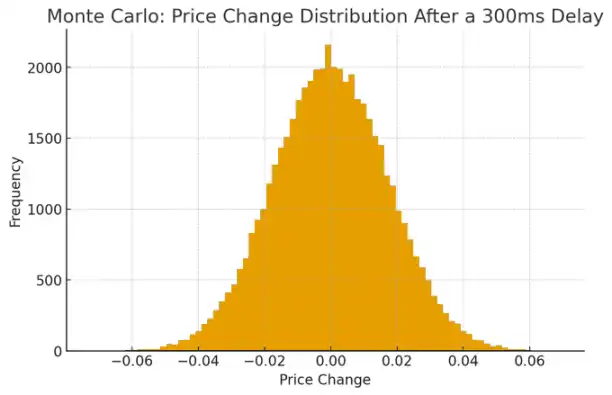

What Does 300 Milliseconds Really Mean?

An average human blink takes about 100-150 milliseconds. By the time you blink twice, faster traders have already captured price movements, adjusted positions, and engaged in a trade against you.

The crypto market is highly volatile, with typical volatility levels (50-80% annualized), causing prices to move about 0.5 to 1 basis point per second.

This means that within 300 milliseconds, market noise alone can cause prices to move on average 0.15-0.30 basis points.

The True Cost of "Free"

If we quantify it:

Academic research on adverse selection costs (Glosten & Milgrom, Kyle's Lambda, etc.) indicates that the informational advantage of informed traders is usually 2-5 times the magnitude of price random walk.

If the random slippage within 300 milliseconds is about 0.2 basis points, then adverse selection would add an additional 0.4-1.0 basis points.

For active traders and liquidity providers, the actual costs are roughly as follows:

· Standard Account Actual Cost: 6–12 basis points (0.06%–0.12%) per transaction

· Advanced Account Actual Cost: 0.2–2 basis points (0.002%–0.02%) per transaction

The cost of a "free" account is 5–10 times higher than that of a paid account.

Zero transaction fee is just a marketing number; the real cost is hidden in the latency.

The advanced account is actually more cost-effective, without a doubt

In any case, the standard account (0% fee) is not the preferable choice.

It is not suitable for small retail investors, large holders, scalpers, day traders, or even passive investors. Especially not for liquidity providers, or anyone, for that matter.

"I am just a small retail investor; I don't need an advanced infrastructure."

Wrong.

Small retail investors are more vulnerable to slippage. If you trade with $1,000 and lose 10 basis points per trade, it is like losing $1 each time. After 50 trades, 5% of your account will silently disappear.

"I don't trade frequently; latency doesn't affect me."

Also wrong.

If you don't trade frequently, the cost of an advanced account is negligible anyway.

Yet even in a few trades, the execution price you receive is still worse. Since the cost of avoiding such losses is almost zero, why accept any disadvantage?

Directly upgrade to an advanced account.

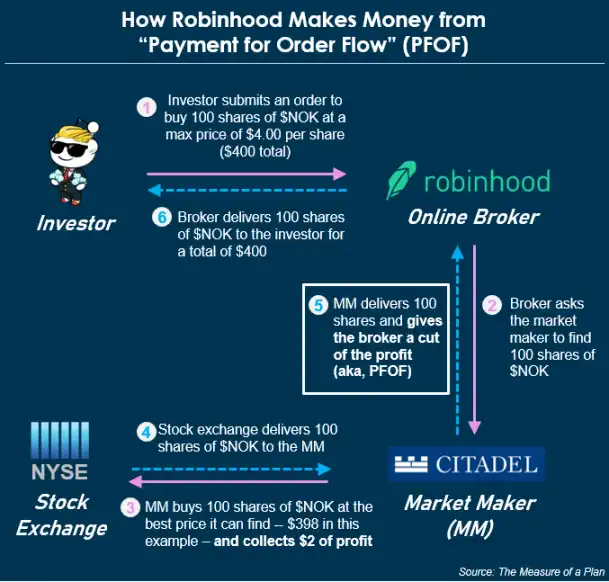

This model has a precedent

The traditional financial markets have long witnessed this tactic, known as payment for order flow.

@RobinhoodApp once attracted retail investors with "commission-free trading," then routed orders to liquidity providers, allowing them to profit by trading against the uninformed orders of retail investors, thus popularizing this model.

Lighter's model is structurally similar to this. Standard accounts do not receive free trades; they receive slower trades. This latency is transformed into profit by faster participants.

The trading platform does not need to charge you a fee because you are actually paying with execution quality.

What Lighter Did Right and Wrong

Lighter did not conceal latency data, as it was clearly stated in the documentation.

However, transparency does not equal clarity.

By highlighting "0% Fee" in the headline but burying "300ms Latency" in the fine print, Lighter employed a strategy focused on registration conversion rates rather than user understanding.

Most retail traders do not understand the implications of latency, are unaware of adverse selection, and naturally cannot calculate the equivalent actual cost.

Lighter is clear about this.

Advanced accounts are more cost-effective in every way compared to the standard "zero-fee" account—there is no debate about this.

You may also like

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…

Gold to $10,000 and Silver to $150: My Wild, Or Perhaps Not-So-Wild 2026 Price Predictions

Key Takeaways Geopolitical uncertainties are significantly driving up the demand for gold and silver, suggesting the prices may…

Hong Kong Enhances Gold Market Access Through Hang Seng Gold ETF and Tokenized Units

Key Takeaways: The Hang Seng Gold ETF offers Hong Kong investors direct access to gold by launching a…

Japan’s Metaplanet Announces $137 Million Capital Raise Via Third-Party Allotment

Key Takeaways Japanese firm Metaplanet Inc. has strategized a $137 million capital raising through the third-party allotment of…

SEC Warns Tokenization Is Not A Workaround For Securities Compliance

Key Takeaways: The U.S. Securities and Exchange Commission (SEC) emphasizes that tokenizing financial securities does not exempt them…

Dogecoin Price Prediction: DOGE Founder Reveals True Cause of Crypto Market Downturn

Key Takeaways: The recent downturn in the cryptocurrency market, including Dogecoin, is attributed to shifting investor behavior rather…

US Senators Criticize DOJ Over Crypto Crime Unit Closure Amid Financial Conflict Concerns

Key Takeaways: Six US senators have criticized Deputy Attorney General Todd Blanche for shutting down the DOJ’s crypto…

Bitpanda and Ribbon Plc to Unveil Comprehensive Crypto Services in the UK

Key Takeaways Bitpanda Technology Solutions collaborates with Ribbon Plc to launch digital asset services in the UK. The…

Crypto PAC Fairshake Secures $193 Million as US Crypto Vote Looms

Key Takeaways: Fairshake, a prominent crypto-focused political action committee (PAC), has amassed $193 million in fundraising as Congress…

Crypto Crime Hits $158B in 2025 – But Illicit Use Keeps Declining, Says TRM

Key Takeaways TRM Labs reports a 145% increase in illicit crypto-related transactions reaching $158 billion in 2025, yet…

Bybit to Introduce Dollar Accounts With Partner Banks – Can Crypto Go Mainstream?

Key Takeaways Bybit plans to introduce “MyBank” dollar accounts in partnership with licensed financial institutions, enhancing seamless conversion…

a16z-Backed Crypto Custody Startup to Close, Returning Investor Capital

Key Takeaways Entropy, a decentralized crypto custody startup, is closing its doors after four years due to strategic…

How a Harmless "AI Trading Tool" Became a $Million Crypto Bubble: The Clawdbot Fiasco Explained

Clawdbot Case: How a Non-Trading AI Tool Got Hyped Into a $1M Crypto Bubble | Exposing Market FOMO and Fake Token Scams (With On-Chain Evidence)

Hong Kong-Based OSL Group Launches $200M Equity Raise for Stablecoin and Payments Expansion

Key Takeaways OSL Group, a prominent digital asset platform in Asia, has initiated a significant $200 million equity…

Gold Price Prediction: Current Trends and Future Outlook for January 28, 2026

Key Takeaways Gold and silver prices play a significant role in the global economy, reflecting both market trends…

Central Bank of the UAE Endorses First USD-Backed Stablecoin

Key Takeaways The UAE Central Bank has endorsed the first US dollar-backed stablecoin, USDU, to streamline compliant settlements…

Can the Gold Price Rise to $6,000?

Key Takeaways Gold prices in 2026 have experienced dramatic surges, reaching unprecedented levels in just the first month…

Talos Raises $45M Series B Extension Backed by Robinhood, Bringing Total Funding to $150M

Key Takeaways: Talos, a leading provider of institutional digital asset trading technology, has raised $45 million in a…

What is the Next Milestone for Gold Prices and Will It Reach $6,000 by Year End?

Key Takeaways: Gold prices recently crossed the $5,000 per ounce mark, spurring predictions of further increases amidst global…