8 years ago a book that made Saylor go all-in on Bitcoin, gave Silver the "death sentence"

Original Title: "A Book About Bitcoin from 8 Years Ago is Now 'Predicting' the Silver Crash?"

Original Author: David, Deep Tide TechFlow

In 2020, MicroStrategy founder Michael Saylor read a book and decided to buy $425 million worth of Bitcoin.

The book is called "The Bitcoin Standard," published in 2018, translated into 39 languages, with sales over a million copies, revered by Bitcoiners as the "Bible."

The author, Saifedean Ammous, holds a Ph.D. in Economics from Columbia University, and the core argument is simple:

Bitcoin is a harder "hard currency" than gold.

Moreover, on the book's back cover, Michael Saylor's endorsement reads:

"This book is a work of genius. After reading it, I decided to buy $425 million worth of Bitcoin. It had the most profound impact on MicroStrategy's thinking, leading us to shift our balance sheet to a Bitcoin standard."

However, there is a chapter in this book that is not about Bitcoin. It explains why silver cannot become hard money.

Today, 8 years later, silver has just surged to a historic high of $117, the precious metals investment frenzy continues, with even Hyperliquid and various CEXs starting to offer precious metals contract trading in different forms.

Usually, at such times, there are always whistleblowers and contrarians who play the role of reminding about risks, especially in an environment where everything is rising except Bitcoin.

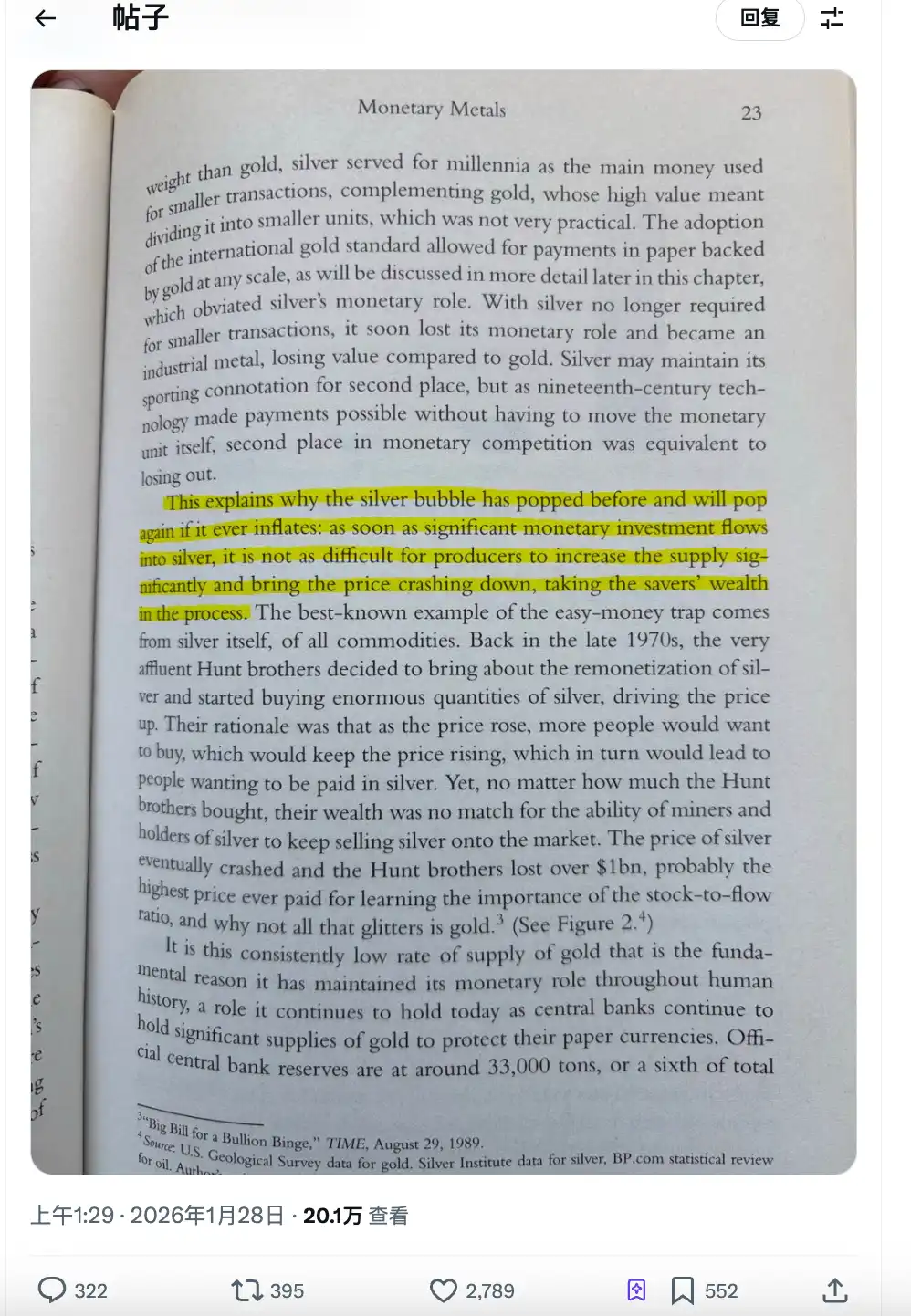

For instance, a widely circulated post on Crypto Twitter today highlighted a screenshot of page 23 from this book, with the following passage:

Every silver bubble bursts, and the next one will be no exception.

Silver Speculation History

Before rushing to criticize, let's take a look at what this core argument really means.

The core argument in this book is actually called stock-to-flow. BTC OGs should have heard of this theory to some extent.

In plain language, for something to become "hard money," the key is how difficult it is to increase its supply.

Gold is hard to mine. The global above-ground gold stock is about 200,000 tons, with an annual addition of less than 3,500 tons. Even if the gold price doubles, miners cannot suddenly double the amount of gold mined. This is called "supply rigidity."

Bitcoin is even more extreme. The total supply is capped at 21 million coins, halving every four years, and no one can change the code. This is scarcity created by algorithm.

What about silver?

The highlighted excerpt in the book roughly states: The silver bubble has burst before and will burst again in the future. This is because once a large amount of money flows into silver, miners can easily increase the supply, driving the price down and causing the wealth of savers to evaporate.

The author also gave an example: the Hunt Brothers.

In the late 1970s, Texas oil tycoons the Hunt Brothers decided to hoard silver, attempting to corner the market. They bought billions of dollars' worth of silver and futures contracts, pushing the price from $6 to $50, setting a historic high for the silver price at the time.

And then? Miners frenziedly unloaded silver, trading platforms raised margin requirements, and the silver price collapsed. The Hunt Brothers lost over $1 billion and eventually went bankrupt.

Therefore, the author's conclusion is:

Silver's supply elasticity is too high, making it impossible to become a store of value. Every time someone tries to hoard it as "hard money," the market will teach them a lesson with increased supply.

When this logic was written in 2018, silver was $15 per ounce. Few cared.

Is this round of silver different?

For the above logic about silver to hold true, there is a premise: if the silver price rises, the supply can keep up.

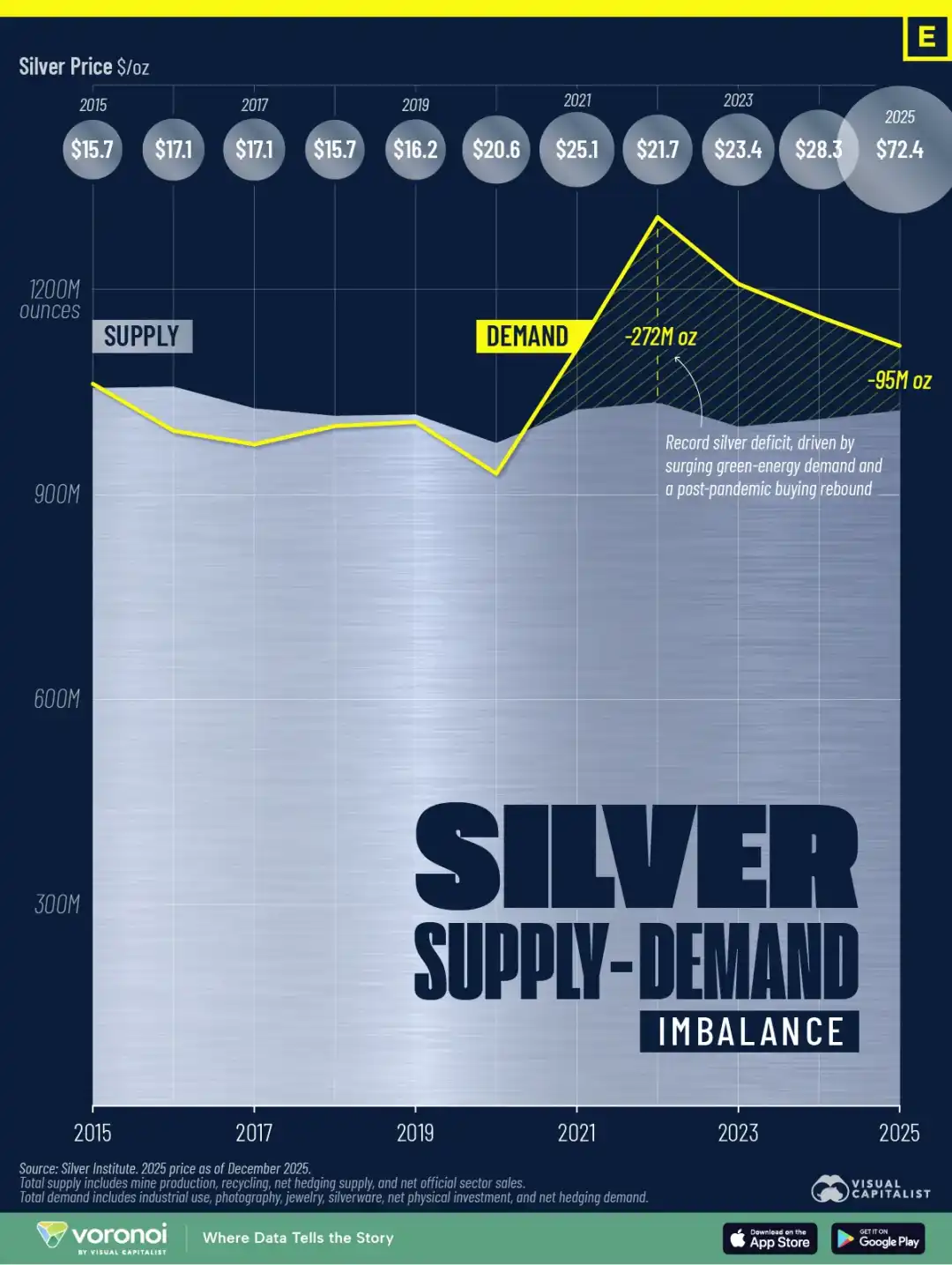

However, 25 years of data tell a different story.

Global silver mine production peaked in 2016 at about 900 million ounces. By 2025, this number had dropped to 835 million ounces. The price increased by 7 times, but production decreased by 7%.

Why Is the Logic of "Price Increase Leads to Production Increase" No Longer Effective?

One structural reason is that about 75% of silver is produced as a by-product of copper, zinc, and lead mining. Miners' production decisions are based on the prices of base metals, not silver. If the price of silver doubles but the price of copper remains the same, mines will not ramp up production.

Another reason could be time. From exploration to production, the cycle of a new mining project is 8 to 12 years. Even if construction were to start immediately, no additional supply would be seen before 2030.

The result is a five-year consecutive supply deficit. According to data from the Silver Institute, from 2021 to 2025, the global silver cumulative deficit is close to 820 million ounces, which is almost equivalent to the entire annual global mine production.

Meanwhile, silver inventories are also hitting rock bottom. The London Bullion Market Association's deliverable silver inventory has dropped to only 155 million ounces. The silver lease rate has surged from 0.3%-0.5% in normal years to 8%, meaning someone is willing to pay an 8% annualized cost just to ensure they can get physical delivery.

There is also a new variable. Starting January 1, 2026, China has implemented export restrictions on refined silver, where only state-owned large refineries with an annual capacity exceeding 80 tons can obtain export permits. Small and medium-sized exporters are directly shut out.

In the era of the Hunt Brothers, miners and holders could use increased production and selling pressure to suppress prices.

This time, the ammunition on the supply side may not be sufficient.

It's Speculation and Utility

When the Hunt Brothers hoarded silver, silver was a speculative asset. Buyers were thinking: the price will rise, so they stockpiled it to sell later.

The upward trend of silver in 2025 has a completely different driving force.

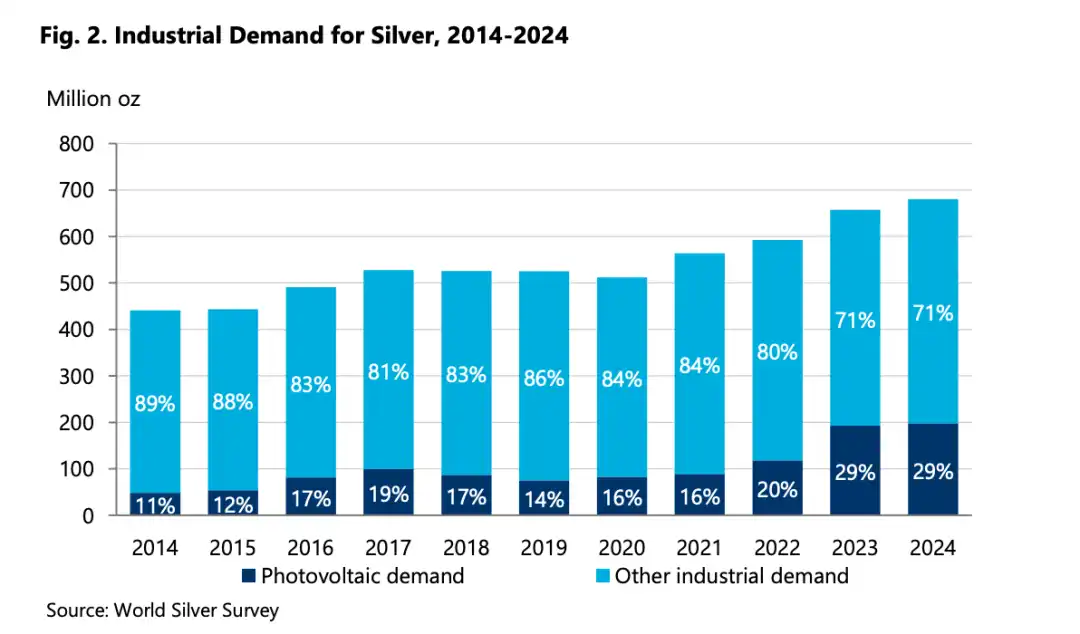

First, look at a set of data. According to the World Silver Survey 2025 report, industrial demand for silver reached 680.5 million ounces in 2024, a historical high. This figure accounts for over 60% of global total demand.

What is driving industrial demand?

Solar Photovoltaics: Every solar panel requires silver paste as a conductive layer. The International Energy Agency predicts that global solar photovoltaic capacity will double by 2030. The solar industry is already the largest single industrial buyer of silver.

Electric Vehicles. A traditional gasoline car uses about 15-28 grams of silver. An electric vehicle uses 25-50 grams, with higher-end models using more. Silver is used everywhere from the battery management system, motor controller, to the charging port.

AI and Data Centers. Servers, chip packaging, high-frequency connectors, silver's conductivity and thermal properties are irreplaceable. This demand is expected to accelerate starting in 2024, with the Silver Institute specifically listing "AI-related applications" in their report.

In 2025, the U.S. Department of the Interior included silver in the "critical minerals" list. The last time this list was updated, lithium and rare earths were added.

Of course, maintaining a high silver price will lead to a "silver-saving" effect, such as some solar panel manufacturers already reducing the amount of silver paste per panel. However, the Silver Institute's forecast is that even considering the silver-saving effect, industrial demand will remain close to record levels in the next 1-2 years.

This is actually a rigid demand, something that Saifedean may not have foreseen when he wrote "The Bitcoin Standard."

A Book Can Also Provide Psychological Massage

The narrative of Bitcoin as "digital gold" has recently been muted compared to real gold and silver.

The market has called this year the "debasement trade": the weakening of the U.S. dollar, rising inflation expectations, geopolitical tensions, and funds flowing into hard asset havens. However, this wave of safe-haven funds chose gold and silver, not Bitcoin.

For Bitcoin extremists, this requires an explanation.

So the book mentioned above has become a classic reference and a defense of a position: silver is rising now because of a bubble; wait for it to burst, and then you will know who was right.

This is more like a narrative self-rescue.

When the asset you hold underperforms the market for a whole year, you need a framework to explain "why I am still right."

Short-term prices are not important; long-term logic is crucial. The logic of silver is wrong, the logic of Bitcoin is right, so Bitcoin will inevitably outperform, it's just a matter of time.

Is this logic internally consistent? It is. Can it be falsified? It's difficult.

Because you can always say, "time has not been long enough."

The problem is, the real world doesn't play by the rules. Holding Bitcoin and altcoins in hand, brothers who stay true to the crypto circle are really anxious.

The Bitcoin theory written down 8 years ago cannot automatically cover the reality of no price increase 8 years later.

As silver continues to skyrocket, we also sincerely wish Bitcoin good luck.

You may also like

You can turn anything into a meme, but remember to cherish this cathedral

Key Market Information Discrepancy on January 29 - A Must-Read! | Alpha Morning Report

8 years ago a book that made Saylor go all-in on Bitcoin, gave Silver the "death sentence"

The Fed Keeps Interest Rates Unchanged, Sending Markets into a "Two-Speed" World

CZ Caught in International Public Opinion Storm, a16z Increases $HYPE Position, Mainstream Ecosystem Update

Key Market Intelligence on January 29th, how much did you miss?

Zcash Founder Discusses Privacy, Artificial Intelligence, and How ZEC Could Become the "Cryptographic Bitcoin"

![[LIVE] Crypto News Today: Latest Updates for Jan. 23, 2026 – BTC Slides Below $90K as Crypto Market Extends Broad Sell-Off](https://weex-prod-cms.s3.ap-northeast-1.amazonaws.com/medium_21_2c30f7df62.png)

[LIVE] Crypto News Today: Latest Updates for Jan. 23, 2026 – BTC Slides Below $90K as Crypto Market Extends Broad Sell-Off

Key Takeaways The crypto market is in a downward trend, with GameFi, AI, and RWA sectors showing some…

XRP Price Prediction: $1.88 Triple-Bottom Support Amid ETF Money Pull Back – Analyzing Future Directions

Key Takeaways XRP currently stabilizes around $1.88 with triple-bottom support after recent price slips below $2.00. Institutional ETF…

CZ Declares He Won’t Return to Binance After Trump Pardon – What’s Going On?

Changpeng Zhao (CZ) has confirmed he will not return to Binance following his presidential pardon from Donald Trump.…

Cryptocurrency Price Prediction Today 23 January – XRP, Bitcoin, Ethereum

Key Takeaways Bitcoin, Ethereum, and XRP are in distinct phases of consolidation or resistance, with potential for significant…

Bitcoin & Ethereum ETFs Shed Over $1Billion, Solana and XRP Attract Inflows

Key Takeaways Bitcoin and Ethereum ETFs experienced substantial outflows exceeding $1 billion in just one day, reflecting a…

Shiba Inu Price Prediction: SHIB Team Asserts ‘We’re Not Done Yet’ – Is a Parabolic Move Imminent?

Key Takeaways: Shiba Inu core members suggest the current market cycle may not be complete, hinting at potential…

Solana Price Prediction: Why $126 Could Be the Calm Before SOL’s Next Surge

Key Takeaways Solana’s price hovers around $126, showing signs of stability despite a recent pullback, as traders remain…

Bitcoin Price Prediction: Rich Dad Poor Dad Author Kiyosaki Shrugs Off Price Crash – Here’s Why He’s More Optimistic Than Ever

Key Takeaways Robert Kiyosaki, author of “Rich Dad Poor Dad,” remains bullish on Bitcoin despite recent price fluctuations.…

XRP Price Outlook: Steady Gains Amid ETF Revival – Are Whales Ahead of the Curve?

Key Takeaways XRP-linked exchange-traded funds (ETFs) have resumed accumulation after a brief market dip. The resurgence of ETF…

US Spot Bitcoin ETFs Experience Significant Declines with $1.33 Billion Outflows

Key Takeaways: US Spot Bitcoin ETFs faced their most significant weekly losses in almost a year with $1.33…

Top Instant Withdrawal Crypto Casinos for Fastest Payouts in 2026

Key Takeaways: Instant withdrawal crypto casinos facilitate quick and secure payouts, often requiring only a few minutes. These…